Dubai continues to attract entrepreneurs and startups from around the world. With its strategic location, tax-friendly policies, and world-class infrastructure, the city remains one of the top destinations for business setup in 2026.

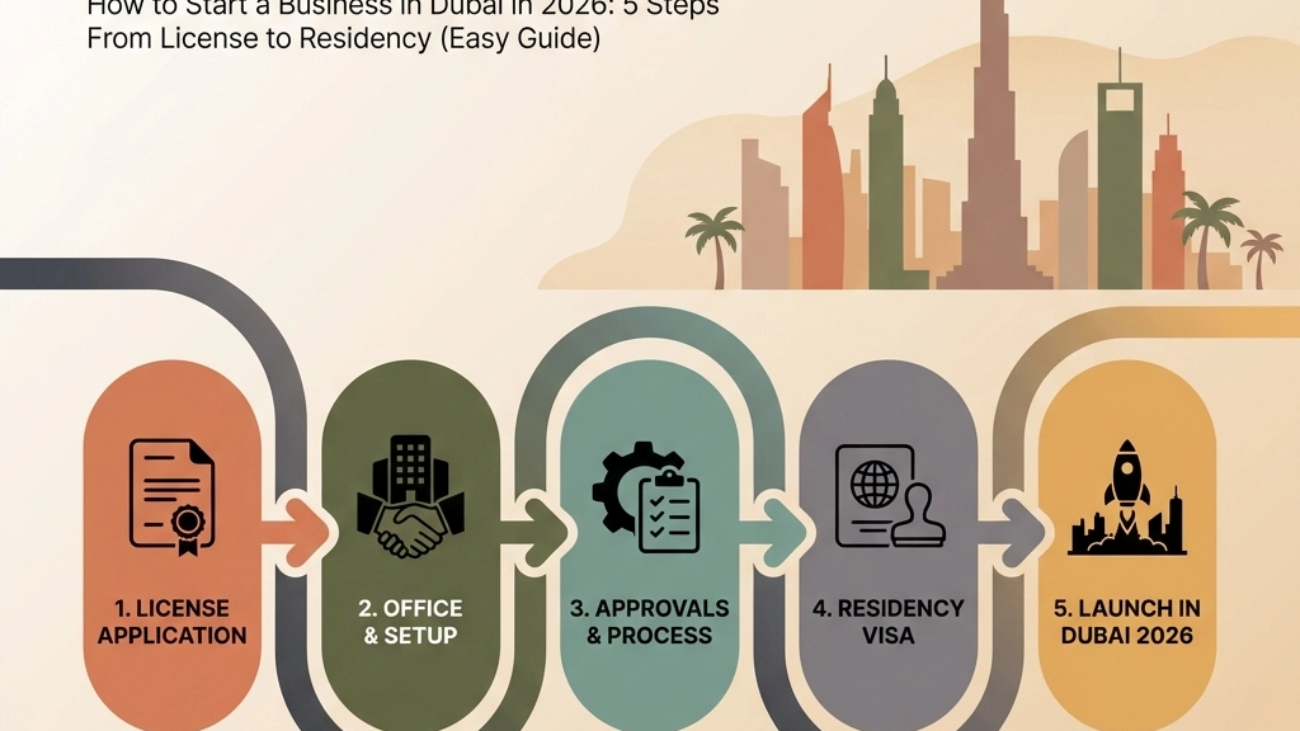

Whether you're launching a consultancy, e-commerce venture, or trading company, understanding the company setup Dubai process is essential. This guide walks you through five clear steps: from choosing your business structure to obtaining residency through your investment.

Why Dubai Remains a Top Choice for Entrepreneurs in 2026

Before diving into the steps, it's worth noting why Dubai stands out. The UAE offers 100% foreign ownership for most business activities, no personal income tax, and access to markets across the Middle East, Africa, and Asia. The government has streamlined many processes, making business setup Dubai faster and more accessible than ever.

Now, let's break down exactly what you need to do.

Step 1: Choose Your Business Activity and Company Structure

Your first decision shapes everything that follows. You need to identify your business activity and select the right company structure for your goals.

Identify Your Business Activity

Dubai categorizes businesses by specific activity codes. Common categories include:

- Trading (import/export, general trading)

- Professional services (consulting, marketing, IT)

- E-commerce (online retail, digital services)

- Manufacturing (production, assembly)

Your chosen activity determines which licenses you qualify for and which authority handles your application.

Select Your Company Structure

There are three main structures for company setup Dubai:

Mainland (Onshore)

Mainland companies are licensed by Dubai's Department of Economy and Tourism (DET). This structure allows you to operate anywhere in the UAE, work with government contracts, and engage in unlimited business activities. You'll need a physical office address, and costs tend to be higher than other options.

Free Zone

Free zones are designated areas with their own licensing authorities, such as DMCC, JAFZA, or Dubai Internet City. Free zone companies offer benefits like flexible office arrangements (including flexi-desk options), simplified setup procedures, and often lower initial costs. However, conducting business directly within the UAE mainland requires additional permits.

Offshore

Offshore companies are suitable for holding assets, international trading, or managing investments outside the UAE. These entities cannot conduct business within the UAE but offer privacy and tax advantages for international operations.

For most entrepreneurs planning to operate locally, mainland or free zone structures are the practical choices.

Step 2: Reserve Your Trade Name and Obtain Initial Approval

With your activity and structure decided, the next step involves securing your business identity and getting official approval to proceed.

Choose a Compliant Trade Name

Your trade name must meet specific requirements:

- It should reflect your business activity

- It cannot include prohibited or offensive terms

- It must be unique and not already registered

- Religious or political references are not permitted

You can check name availability through the DET portal for mainland companies or your chosen free zone authority.

Submit Your Initial Approval Application

Initial approval confirms that your proposed business activity is acceptable and that you can proceed with registration. For mainland companies, you submit this through the DET. For free zone companies, each authority has its own application portal.

If your business involves sensitive activities: such as financial services, healthcare, or education: you may need additional approvals from relevant ministries before proceeding.

Step 3: Prepare Legal Documentation and Secure Office Space

Documentation requirements vary slightly between mainland and free zone setups, but the fundamentals remain consistent.

Draft Your Memorandum of Association (MOA)

The MOA is a legal document that outlines:

- Ownership structure and share distribution

- Business activities

- Roles and responsibilities of shareholders and managers

For mainland companies, the MOA must be notarized and signed by all partners. Free zone authorities typically have standardized templates that simplify this process.

Gather Required Documents

Standard documentation includes:

- Passport copies for all shareholders, managers, and directors (valid for at least six months)

- Proof of address (utility bills or bank statements)

- No-objection certificate (NOC) if currently employed in the UAE

- Business plan (required by some free zones)

Secure Your Office Space

Office requirements differ by structure:

Mainland companies require a physical office with a registered tenancy contract (Ejari). The space must comply with municipal regulations for your business activity.

Free zone companies offer more flexibility. Many zones provide flexi-desk arrangements, co-working spaces, or virtual office options. You'll still need proof of lease or a facility agreement from the zone authority.

Step 4: Submit Documents and Obtain Your Dubai Business License

This step brings together all your preparation. You're now ready to officially register your company and receive your Dubai business license.

Submit Your Application Package

Compile and submit the following to your licensing authority:

- Completed application form

- Memorandum of Association

- Trade name reservation certificate

- Initial approval documentation

- Office lease agreement (Ejari for mainland)

- Passport copies and photographs

For mainland companies, submission happens through the DET or approved service centres. Free zone companies submit directly to their zone authority.

Pay Fees and Receive Your License

Once your application is approved, you'll pay the required fees, which typically include:

- License issuance fee

- Registration fee

- Trade name reservation fee

- Office rental (if applicable)

Costs vary significantly based on your chosen structure, business activity, and office type. Budget between AED 15,000 to AED 50,000 for most standard setups, though complex activities may cost more.

Upon payment, you'll receive your official trade license certificate. This document displays your company name, registered owners, approved activities, and business address. Your company is now legally established in Dubai.

Step 5: Open a Corporate Bank Account and Obtain Your Investor Visa

With your license in hand, two critical steps remain: banking and residency.

Open a Corporate Bank Account

A corporate bank account is essential for conducting business in Dubai. Banks require:

- Original trade license

- Memorandum of Association

- Passport copies of shareholders and signatories

- Proof of business address

- Initial deposit (varies by bank)

The process typically takes two to four weeks. Banks conduct due diligence checks, so be prepared to provide additional documentation about your business activities and source of funds.

Apply for Your Investor Visa and Residency

One of the major advantages of business setup Dubai is the pathway to residency. As a company owner, you qualify for an investor visa, which grants:

- Legal residency in the UAE

- Ability to sponsor family members

- Access to Emirates ID and local banking services

- Freedom to rent property and obtain a UAE driving license

The visa application process involves:

- Applying for entry permit through your licensing authority

- Completing a medical fitness test

- Submitting biometrics for Emirates ID

- Visa stamping in your passport

Most investor visas are valid for two or three years, with longer-term options (five or ten years) available for qualifying investments.

Register for VAT (If Applicable)

If your business expects annual turnover exceeding AED 375,000, VAT registration with the Federal Tax Authority is mandatory. Voluntary registration is available for businesses with turnover above AED 187,500.

Keep Your Business Compliant

Once established, maintaining compliance ensures smooth operations:

- Renew your trade license annually

- File VAT returns quarterly (if registered)

- Keep accounting records for at least five years

- Update authorities on any changes to shareholders or activities

Ready to Start Your Dubai Business?

The company setup Dubai process is straightforward when you understand each step. From choosing the right structure to obtaining your residency visa, proper planning makes all the difference.

If you're considering launching your business in Dubai and want expert guidance through the process, get in touch with our team. We help entrepreneurs navigate every stage of business setup( from initial planning to post-incorporation support.)